Executive Summary

This report looks at the history of superannuation for Australian women, marks its progress towards equity, and identifies what more could to be done to improve the system in order to mitigate women’s vulnerability to poverty in retirement.

An overview of the various employer-designed superannuation schemes that existed prior to the introduction of universal superannuation reveals the history of direct and indirect discrimination against women in the provision of retirement saving systems. The slow rate of growth in coverage of Australian women by private superannuation schemes is outlined, and it reveals the historical reliance of women on their partner’s income and retirement savings, and their resulting financial insecurity throughout the twentieth century.

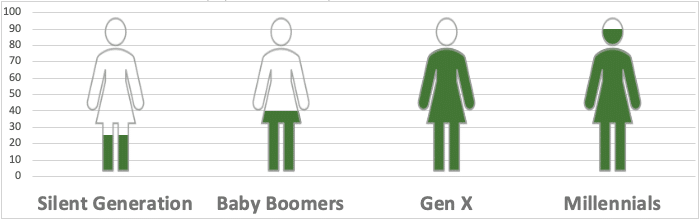

To illustrate the incremental improvements in women’s retirement incomes resulting from the gradual extension of superannuation to women over the last half century, the report tracks the transition from the experiences of the ‘silent generation’, who retired without significant independent superannuation funds, to the ‘baby boomer’ generation who have begun to experience the benefits of superannuation incomes in retirement. This comparison clearly shows the positive impact on women’s financial security of the superannuation revolution.

It is not until the ‘Gen X’ and ‘Millennial’ generations that women have been in receipt of compulsory superannuation throughout their working lives and have therefore been able to save for their retirement.

Even so, our analysis shows that the design of universal superannuation, primarily its flat tax structure and its indifference to the nature of women’s labour force participation, as well as a number of policy interventions in the years since its introduction that have deliberately favoured higher-income men, means that these younger generations of Australian women are also likely to retire with significantly less superannuation than are their male peers, and many will not accrue sufficient savings for a secure retirement.

The report concludes with some recommendations for addressing the gender inequity in retirement incomes that mean Australian women are significantly more likely to live in poverty in older age than are men.

Figure 1– Percentage of female population with superannuation on retirement by generation