Every year, progressive think tank Per Capita releases its fantasy budget: a set of budget priorities that, if implemented, would progress Australia towards a more equal society. This year our budget priorities are:

Increase Newstart by $75 per week

It’s now widely accepted that Newstart payments are too low to support a dignified life, and actually hinder the efforts of unemployed workers to effectively search for work. Numerous pieces of research, including our own report Working it Out, have documented the poverty experienced by Australia’s unemployed workers. Per Capita’s call for a raise in the rate of Newstart echoes campaigns by prominent individuals and organisations across the country including the Australian Council of Social Services and the Business Council of Australia.

Increase Commonwealth Rent Assistance (CRA) to align with housing costs

Our work with pensioners, unemployed workers, and older women at risk of homelessness has highlighted the financial gulft between homeowners and renters. Pensioners who rent experience substantial material deprivation and poverty, and unemployed workers who rent in the private rental market live well below the poverty line. Similarly, meeting rent payments is among the greatest stresses for older women living in, or at risk of, poverty.

Fully fund home care packages for pensioners in order to allow more Australians to remain in their homes and in their communities as they age

Current waiting periods for appropriate home care can be over 12 months, which is unacceptable in one of the richest countries in the world. These packages should be fully funded to meet the demand.

Lift the public sector wage freeze

The Commonwealth Government is such a large employer that public service wages play a significant role in nationwide wage setting. As a result, the current freeze is contributing to the wage stagnation currently occurring across the entire economy. The wage freeze also erods the quality of the public service itself. The freeze on wage rises for public servants should be lifted immediately.

Repeal the upcoming flattening of the personal income tax scale

Australia’s current income tax regime is highly progressive with the most taxes froming from those who can most afford to pay them. The personal income tax changes set to take effect in 2022 and 2024 will greatly reduce the progressivity of the tax system, with the overwhelming share of the benefit going to high income earners. These tax changes will exacerbate inequality in Australia, widening the gap between the haves and the have-nots.

Use commodity booms to invest in the future

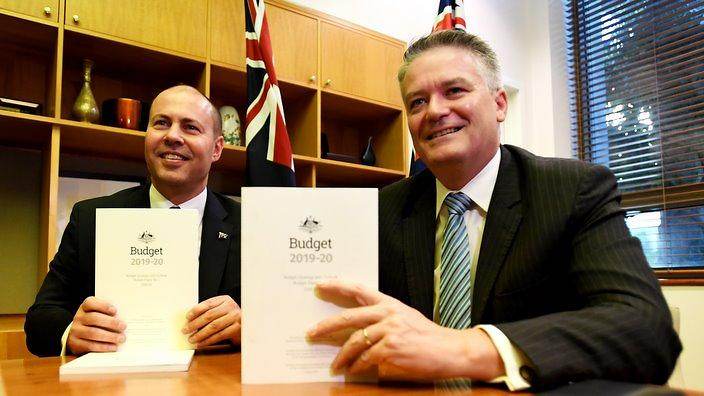

We need to ensure that temporary windfall gains from increases in commodity prices are not used to justify recurring expenditure or tax cuts. The Howard and Costello government famously used the proceeds of the temporary mining boom of the early 2000s to fund permanent income tax cuts. There are signs the Morrison government is about to repeat this mistake. Mineral resource exports should not be treated as income; they better understood as asset sales. The one-off sale of these national assets should be used to invest in our collective future. The first step is to ensure that the Australian people receive a good price for our mineral resources through the introduction of a mineral resource rent tax. The proceeds of this tax should be used to fund social and physical infrastructure that improves our productivity, reduces our reliance on raw materials exports and thus our vulnerability to changes in global markets, and sets us up for a future economy that is not reliant on mining and exporting mineral resources.

A gender responsive budget

The Government should immediately reinstate the Gender Budget Statements. This will be the fourth year without any economic analysis by Treasury of the impact of the budget on women. The failure to provide sex dis-aggregated economic data runs parallel with Australia’s slide on the World Economic Forum’s Global Gender Gap Index. The failure to account for the way revenue and spending affects women and men differentially is contributing to Australia’s poor global equity performance – we’re down another four points from 35 to 39 behind New Zealand, all the Nordic countries, the Philippines and Afghanistan. A Gender Budget Statement, with data collection and distribution undertaken by Treasury and the Office of Women jointly, along with the funding of non-government organisations to provide independent analysis, is critical business to ensuring we close the gender pay gap and alleviate the burden of an inflated Effective Marginal Tax Rate for women, and the motherhood and retirement penalties.

Increase funding the ABC and SBS

The Government should not only reinstate the $631million of funding it has cut from the ABC budget over the last six years, it must increase base funding for both national broadcasters to allow them to invest in quality, independent journalism, adequately cover and distribute its content to regional Australia, invest in new digital distribution technologies, and produce more original Australian content, including scripted drama and children’s programs. At a time when the business model for commercial journalism is facing collapse, fake news is on the rise and the proliferation of over-the-top digital content platforms is flooding our media landscape with international content, it is critical that we invest in our trusted public broadcasters to tell our own stories and provide the essential information on which our healthy democracy relies.

Crack down on corporate tax avoidance

Many of the biggest companies operating in Australia pay little or no tax in this country despite multi-billion dollar turnovers. Our annual tax survey showed again this year that the Australian people want these companies to pay their fair share of tax.

Restrict negative gearing and reduce the concession on capital gains tax

Per Capita has long argued for these reforms and we support the Opposition’s policies.

Phase out all federal subsidies for fossil fuel projects

Federal government subsidies that encourage fossil fuel consumption and production have been calculated at over $12 billion annually, the largest of which is the Fuel Tax Credit Scheme. These subsidies go primarily to large, multinational mining and energy companies that are currently extremely profitable (despite many paying little or no tax in Australia). Such subsidies should be phased out as part of a move to renewable energy and transport systems, while being mindful of the potential impact on employment in regional Australia.

Abolish the Community Development Program (CDP)

The CDP as currently implemented is a punitive, discriminatory, culturally insensitive and destructive program in Indigenous communities. Analyses have shown that the CDP is “more effective in penalising participants than in finding them meaningful work.” The CDP should be abolished immediately. We believe that remote Indigenous communities would be great places to trial a Job Guarantee program that offers unemployed workers actual jobs at award rates with tasks performed determined according to local community priorities.

Every public school should be funded to 100% of the School Resourcing Standard

The budget should restore the $1.9b cut to public schools from the original Gonski package and the additional cuts to funding for students with a disability. Further, it should provide additional funding so that every public school reaches 100% of the School Resourcing Standard by 2023.

Provide superannuation for carers

There are an estimated 5.5 million Australians in unpaid care work, the majority women caring for a child with disability or ageing parents – or both. A system of ‘carer-credits’ would see government contribute directly to the superannuation of Australians receiving carer or parenting payments. Carers face significant barriers in accumulating retirement savings, yet their contribution to the Australian economy is estimated at hundreds of billions of dollars. A carer credit system would help redress gender inequity in retirement savings, whereby women on average retire with less than half the super of men.