Progressive Economics

We challenge the belief that disadvantage arises from personal fault or failure and point out the policy choices that have deepened inequality in Australia over recent decades. Returns to capital have increased while returns to workers for their labour have stalled. We call out the negative effects of privatisation and the deliberate shrinking of essential public services.

Progressive Economics

December 12, 2025

Submission to Select Committee on the Operation of the Capital Gains Tax Discount

The size of the capital gains tax (CGT) discount, currently 50 per cent, goes beyond the purpose of the discount and undermines the progressive nature of Australia’s personal income tax system. This submission outlines why we believe it is the case.

Progressive Economics

November 20, 2025

Submission to the Inquiry into Building Asia Capability

Our submission outlines practical approaches to strengthening Asia capability across the education system and within broader society, including through diaspora engagement, partnerships, and leadership development.

Progressive Economics

July 28, 2025

Submission to the Economic Reform Roundtable

This submission from Per Capita to the Economic Reform Roundtable builds on the success of our Community Tax Summit and lays the groundwork for a broader tax reform paper to be released later this year.

Progressive Economics

June 11, 2025

Community Tax Summit 2025 – Summary Document

This document summarises the conversations at the Community Tax Summit 2025, held 20-21 February 2025.

Progressive Economics

March 31, 2025

The Lost Decade: How low wage growth stopped young Australians buying a home

This report examines the impact of a Lost Decade, during which real wages barely grew. It explores how this has affected young Australians setting out on their careers, trying to build the financial security needed to buy a home and start a family, and grasp the now elusive great Australian dream of home ownership.

Progressive Economics

February 17, 2025

Per Capita Tax Survey 2024

The Annual Per Capita Tax Survey (Tax Survey) provides an invaluable insight into the views held by Australians from across the country about the role of the tax and transfer system, and attitudes towards the role and value of essential public services in our national life.

Progressive Economics

September 25, 2024

Co-operative Employment Economics: Sustaining Employment and Community Prosperity

An exploratory analysis of the impact of Co-operative and Mutual Enterprise (CME) and Equity Owned Firm (EOF) models on employment returns and employment outcomes

Progressive Economics

February 8, 2024

Submission to the Inquiry into Price Setting Practices and Market Power of Major Supermarkets

Our submission discusses how highly concentrated markets, and the substantial market power of Australia’s supermarket duopoly can harm consumers, workers, and fuel inequality. It makes several recommendations for the committee to consider.

Progressive Economics

September 22, 2023

Submission to the ACTU Inquiry into Price Gouging and Unfair Pricing Practices

Our submission discusses how the state of competition in Australian industries can harm consumers and workers, and fuel inequality. It advocates for expeditious reforms to our consumer and industrial law, to empower consumers and workers, and lessen the effect of future shocks.

Progressive Economics

May 28, 2023

The Australian Inequality Index

The Australian Inequality Index is a ground-breaking new tool that provides a multidimensional measure of inequality across a range of economic, social, and demographic indicators.

Progressive Economics

March 30, 2023

Not a One-Stop Shop: The NDIS in Australia’s social infrastructure

Government support to NDIS Tier 2 services was diminished under the previous government, despite calls from the sector, and the Productivity Commission, to return the scheme to its original design.

Progressive Economics

March 27, 2023

Submission to the Inquiry into the Extent and Nature of Poverty in Australia

Poverty is best understood as neither a personal failing nor as an historical accident. Rather, it is the consequence of power relations, such as those between working people and their employers, or between citizens and the state.

Progressive Economics

March 20, 2023

Multiples Matter: Investigating the support needs of multiple birth families

Families with multiples face a greater set of challenges compared to those with singletons.

Progressive Economics

February 13, 2023

Submission to the Senate Standing Committee on Economics National Reconstruction Fund Corporation Bill 2022

In this submission, The Centre for New Industry (CNI) welcomes the opportunity to make a submission to the Department of Industry, Science and Resources’ consultation on the National Reconstruction Fund (NRF) and argues in favour of the Bill’s passing.

Progressive Economics

October 31, 2022

Per Capita Tax Survey 2022

Now in its 12th iteration, the 2022 Survey comes after perhaps some of the most extraordinary years in living memory, during which every aspect of life was disrupted by the COVID-19 pandemic and resulting recession.

Progressive Economics

August 15, 2022

Submission to the Inquiry into the Repeal of the Cashless Debit Card

Per Capita welcomes the vision and policy leadership shown by the current government in its prioritisation of the scrapping of this harmful, degrading and disempowering policy.

Progressive Economics

July 28, 2022

Our Culture, Our Value: The Social and Economic Benefits of Auslan

The value of language is often taken for granted in both research and policy.

Progressive Economics

April 30, 2022

Our Culture, Our Value: The Costs of Hearing Loss in Australia

Solutions to improve the engagement of Deaf people with gainful employment and service access, will improve both economic and wellbeing outcomes.

Our Media

August 31, 2021

Uniform resource rent tax for a better future

Emma Dawson in Independent Australia

Progressive Economics

May 6, 2021

The Per Capita Tax Survey 2021

Now in its 11th iteration, the 2021 Survey comes after perhaps the most extraordinary year in living memory, during which every aspect of life was disrupted by the COVID-19 pandemic and resulting recession.

Work and Workers

February 12, 2021

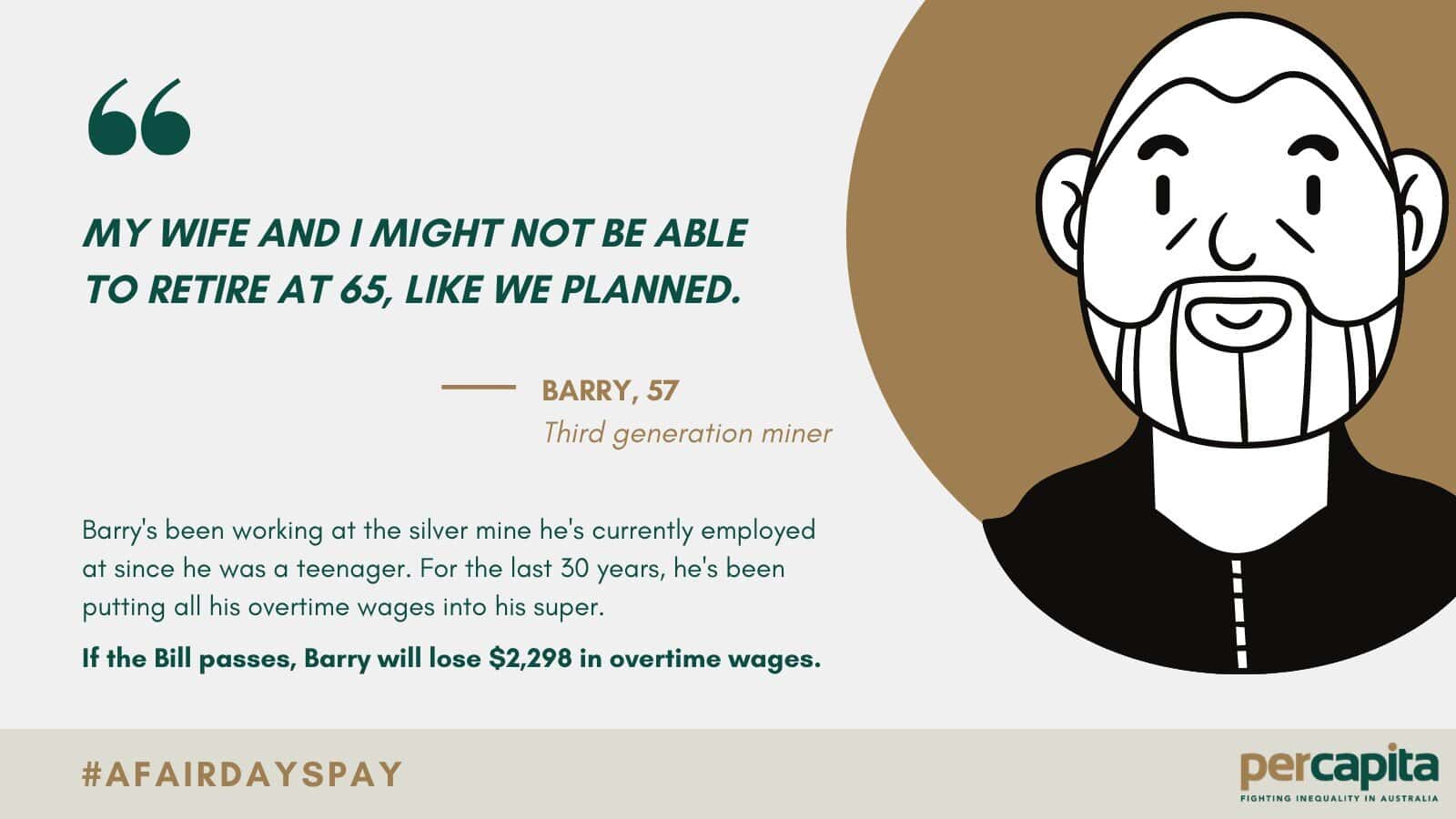

Briefing note: the Fair Work Amendment Bill 2021

The provisions of this Bill would not only fail to solve the problems it claims to address, but would actively entrench job insecurity and low wage growth for millions of working Australians.

Progressive Economics

December 3, 2020

We’ve Got Your Back: Building a Framework that Protects us from Precarity

The social guarantee is a means of acknowledging and addressing the reality of manufactured precarity.

Work and Workers

October 27, 2020

Per Capita Submission to the Inquiry into the JobMaker Hiring Credit Bill 2020

The $4 billion JobMaker Hiring Credit Scheme (the Scheme) is an example of the lack of vision and ambition for Australia’s future that characterized the budget as a whole. While apparently focused on the laudable goal of restoring employment to young workers who have been particularly hard hit by job and income losses in 2020, its design means that it almost certainly will not encourage the necessary corrections to the labour market that are needed to reverse the decline in job security and living standards that have plagued young Australians for more than a decade, and is in fact likely to entrench and exacerbate them.

Work and Workers

October 5, 2020

The Case for a Care-Led Recovery

This paper argues for a significant government investment in the care economy, to create jobs for women, to improve the pay and conditions of essential care workers already in the system, and to improve the quality, affordability and accessibility of care for all Australians.

Progressive Economics

September 15, 2020

The Per Capita Tax Survey 2020

The tenth annual Per Capita Tax Survey provides an unparalleled insight into the views held by Australians of all ages, from across the country, about the role of tax and public services in our national life. For the first time, we have conducted two surveys in 2020 – one in February, immediately before the effects of COVID-19 were widely felt, and a second six months later, in August, when the impact of the pandemic on our society and economy was beginning to be understood.

Work and Workers

July 31, 2020

PostBank: Filling a Void, Securing Essential Services

This discussion paper makes the case for the creation of a public bank in Australia by providing Australia Post with an Authorised Deposit-taking Institution (ADI) licence, and moving in time to establishing PostBank as a full national savings and loan bank.

Work and Workers

June 22, 2020

Mutual Obligation After COVID-19: The Work for the Dole Time Bomb

In this discussion paper we argue that we cannot return to the system of mutual obligation that was in place before the lockdown. The current mutual obligation framework is inflexible and ineffective: a return to this system would impose strict job search requirements that are unreasonable in a labour market where competition for jobs will be fierce.

Work and Workers

June 18, 2020

Coming of Age in a Crisis: Young Workers, COVID-19, and the Youth Guarantee

This report looks at the state of youth unemployment and underutilisation in Australia both before and during the COVID-19 pandemic, and forecasts a likely trajectory for youth unemployment in the months and years ahead.

Work and Workers

May 21, 2020

Slack in the System: The Economic Cost of Underemployment

This new discussion paper estimates the economic cost of underemployment in Australia, both before and during the COVID-19 pandemic.

Progressive Economics

April 17, 2020

Some Facts About Debt

It is critical that the decisions taken in the months ahead are based on facts. What follows are some facts about debt that address the myths that have been circulated, for far too long, about the nature of our economy and its capacity to support a high standard of living for every Australian.

Work and Workers

April 8, 2020

Per Capita Submission to the Inquiry into the Unlawful Underpayment of Employees’ Remuneration

We argue that the government must take wage theft seriously, and that a strong interventionist approach must be taken to ensure the security of work for an entire generation of Australians.

Progressive Economics

February 5, 2020

The Super Freeze: What You’ve Lost

This report, and the accompanying calculator, allows individual workers to assess what the impact of the delay in increasing the SG rate to 12% has been, on both their wages and their super savings, over the last five years and, therefore, is likely to be over the next five.

Progressive Economics

November 15, 2019

Evidence Based Policy Analysis 2019

This report is part of the Evidence Based Policy Analysis Project, administered by the newDemocracy Foundation, and now in its second year. Per Capita was commissioned, alongside the Institute of Public Affairs, to provide analysis of a number of Australian policies introduced at a state and federal level over the two years from July 2017 to June 2019.

Work and Workers

October 1, 2019

Per Capita Submission to the Inquiry into the Adequacy of Newstart and Related Payments

The income support payments to the unemployed, such as Newstart and related payments, are inadequate and do not allow people to maintain an acceptable standard of living.

Work and Workers

September 20, 2019

Per Capita Submission to the Inquiry into Jobs for the Future in Regional Areas

Our unique country, with a vast land mass and low population density, requires unique regional development solutions.

Progressive Economics

May 9, 2019

Meet The Taxpayers: Comparing Labor and the Coalition’s Tax Platforms

The competing tax policies of the Coalition and Labor Parties at the 2019 federal election present voters with the starkest choice on offer for decades. For the first time in a long time, the decision the Australian people make on 18 May will result in markedly different economic outcomes for the country in the decade ahead.

Progressive Economics

April 23, 2019

“Flexible Ongoing” Employment: solving a problem that doesn’t exist

This paper outlines the context within which the flexible ongoing proposal arose, the WorkPac vs. Skene decision. It examines the nature of casual work in Australia and provides an analysis of how the proposed flexible ongoing category would affect workers in Australia.

Ageing

April 2, 2019

Per Capita’s 2019 Fantasy Budget

Every year, progressive think tank Per Capita releases its fantasy budget: a set of budget priorities that, if implemented, would progress Australia towards a more equal society. Here are our budget priorities this year.

Progressive Economics

March 22, 2019

Analysis: ALP and LNP jobactive reforms

Since we published Working It Out: Employment Services in Australia last year, both the Government and the Opposition have announced packages of reforms to Jobactive. In this follow-up report, we compare the platforms to each other and analyse them against the recommendations we made in Working It Out.

Progressive Economics

March 7, 2019

Per Capita Tax Survey 2019

Per Capita is proud to release its 2019 Tax Survey, now in its ninth year. We all pay tax, but this is the only comprehensive, regular survey of Australians’ attitudes to taxation and public spending. It provides information about how we’re thinking now, and how our attitudes to tax and public spending are changing and evolving.

Progressive Economics

November 2, 2018

Submission: Inquiry into the Implications of Removing Refundable Franking Credits

Executive Summary Australia’s dividend imputation system was introduced by then-treasurer Paul Keating in 1987. Its purpose was to eliminate double taxation on dividends from company profits. In 2000, the Howard-Costello Government created a concession within the system that allowed some individuals and superannuation funds to reduce their tax liability beyond zero (as originally allowed) and ... Read more

Progressive Economics

October 5, 2018

Evidence Based Policy Analysis

This report addresses the problem that policymaking in Australia is falling short of best practice. Policies are often built “on the run” as quick reactions to the political issue of the day, designed to capture the interest of the 24-hour news cycle or motivated by short-term political advantage. This can result in failed policy implementation and poor results for citizens, politicians, and society at large, especially when it undermines public confidence in policymaking.

Progressive Economics

September 19, 2018

Working It Out: Employment Services in Australia

The purpose of this report is to critically examine the current mainstream employment services system, jobactive, and assess the experience of unemployed workers with the system against its stated objectives and promised services. A key aim of the research is to bring the voices of unemployed workers in Australia into the public conversation about employment services and about unemployment more broadly.

Progressive Economics

April 30, 2018

Per Capita Tax Survey 2018

Per Capita is proud to release its 2018 Tax Survey, now in its eighth year.

We all pay tax, but this is the only comprehensive, regular survey of Australians’ attitudes to taxation and public spending. It provides information about how we’re thinking now, and how our attitudes to tax and public spending are changing and evolving.

A majority of Australians want to see more government spending on social security. They believe that the wealthy and big business are not paying their fair share, and support for the government’s tax cut for big business is weak.

Progressive Economics

March 29, 2018

Senate Inquiry into the Future of Work and Workers

On Tuesday 13 March, Per Capita's Executive Director, Emma Dawson, and Research Fellow, Tim Lyons, testified before the Senate Select Committee inquiring into the future of work and workers in Melbourne.

Progressive Economics

March 29, 2018

The Cost of Privilege

In a landmark report released on Monday 26 March, undertaken by Per Capita for Anglicare Australia, we revealed that the wealthiest Australians cost the rest of us a staggering $68 billion a year.

Work and Workers

February 28, 2018

The Future of the Fair Go: Securing Shared Prosperity for Australian Workers

The government must intervene to secure the hard-fought-for right of Australian workers to receive a living wage in return for their labour.

Ageing

July 20, 2017

Not So Super, For Women: Superannuation and Women’s Retirement Outcomes

In a significant research collaboration, Per Capita and the Australian Services Union have looked at the way the the super system is failing women.

Progressive Economics

June 12, 2017

Per Capita Tax Survey 2017

Per Capita's annual survey into Australians' attitudes towards taxation and public spending.

Progressive Economics

August 15, 2016

People’s Inquiry into Privatisation

Our services are under threat. Hospitals, schools, TAFE, Medicare, disability care - they are our public services but they can be privatised by politicians and run by companies to make a profit. Communities should have a say over how our services are run, and for whose benefit.

Progressive Economics

April 29, 2016

Per Capita Tax Survey 2016

These findings offer a clear expression of the Australian public's preferred fiscal policy. They'd like taxes raised to fund more spending on services, rather than see spending cut to reflect falling revenues. They'd like to see taxes increased and concessions reduced in ways that increase the overall fairness of the tax system, and they think that corporate tax avoidance in particular is the place to start.

Progressive Economics

April 5, 2016

Action and Impact: Melody Barnes in Melbourne

Melody Barnes served as Assistant to US President Obama and Director of the White House Domestic Policy Council from 2009 to January 2012. Melody is now the Chair of the Aspen Institute's Forum for Community Solutions. Per Capita brought Ms Barnes to Australia for a series of events on building economic growth through social policy, cities and innovation, and insights into her community-based work at the White House.

Progressive Economics

June 9, 2015

Per Capita Tax Survey 2015

June 2015: Per Capita's annual survey into Australians' attitudes towards taxation and public spending, by David Hetherington.

Progressive Economics

April 24, 2015

Paradise Lost? The race to maintain Australian living standards

April 2015: In this report, David Hetherington analyses wage data back to the start of the 2000s to find what is driving the fall in wages growth. The report finds that previous high wage growth can be explained by strong labour productivity, but that these two factors have become increasingly disconnected due to the erosion of the bargaining power of workers.

Progressive Economics

June 21, 2014

Per Capita Tax Survey 2014

There has been a marked turnaround in Australians' attitudes to public spending and tax over the last 18 months. By David Hetherington.

Progressive Economics

March 6, 2013

Per Capita Tax Survey 2012

Public Attitudes towards Taxation and Government Expenditure. Australians' attitudes towards tax and public spending are getting tougher...

Progressive Economics

December 21, 2012

What Price Stability?: Market design in the Australian banking sector

This report examines our banking debate through the prism of market design. It analyses the major faultlines, identifies enduring market failures and proposes a policy response. By David Hetherington.

Progressive Economics

October 21, 2012

Bridging the Divide: How reform consensus can unite Australia’s three economies

Australians will need to choose a new economic strategy to bring together the three sectors of its economy. By Daniel Mookhey.

Progressive Economics

May 21, 2012

After the Party: How Australia spent its mining boom windfall

In this paper, we examine ten years of Commonwealth Budget papers to answer the questions: how did Australia spend its mining windfall? By David Hetherington and Dominic Prior.

Progressive Economics

September 23, 2011

Per Capita Tax Survey 2011

Australians continue to desire a more progressive tax system which sees higher income earners and big business making a greater contribution.

Progressive Economics

September 23, 2011

Just Get Over It: The cost of living in Australia

This paper investigates the cost of living in Australia, an issue that has dominated recent political debate. It evaluates whether cost of living complaints are justified in light of economic reality and household consumption patterns. By Tim Soutphommasane.

Progressive Economics

June 28, 2011

Australia and the Great Recession

A look at the data and analysis about the impact of fiscal stimulus during 2008/09 to examine why Australia was virtually alone among IMF economies in not experiencing a recession during this period. By Chris Barrett.

Progressive Economics

February 24, 2011

What Crisis?: Wellbeing and the Australian quality of life

This report examines state of Australia's quality of life, and finds that, despite concerns, Australians have very little reason to feel a sense of crisis. The paper argues that it is important to understand quality of life as something related to a broader conception of wellbeing. By Tim Soutphommasane.

Progressive Economics

August 21, 2010

Memo to a Progressive Prime Minister: Leadership for the Long Term

The report, published after the 2010 election of Prime Minister Julia Gillard, explores how a progressive agenda can incorporate the building of a stronger, fairer, and more prosperous Australia. By David Hetherington and Tim Soutphommasane.

Progressive Economics

April 24, 2010

Promoting Good Choices: Patterns of Habit and the Role of Government

This paper argues that in Australia, good choices are those which promote the individual and common good, based on the progressive values of prosperity, fairness and community. By Jack Fuller.

Progressive Economics

January 24, 2010

Per Capita Tax Survey 2010

This report presents the results of a Survey undertaken by Per Capita on public attitudes towards taxation in Australia.

Progressive Economics

October 24, 2009

The Philosophy of Tax

October 2009: This paper argues that we need to reposition tax as a public good. It demonstrates how taxation provides valuable economic and social returns, which can empower both the individual and wider society. By Katherine Gregory.

Progressive Economics

September 24, 2009

Heads, You Die: Bad Decisions, Choice Architecture, and How To Mitigate Predictable Irrationality

July 2009: This paper takes a functional approach to taxation and provides principles that can guide better tax policy development - a policy approach that focuses on needs over interests. By Jack Fuller

Progressive Economics

June 24, 2009

Employee Share Ownership and the Progressive Economic Agenda

June 2009: This report argues that share schemes should seek to incentivise investment in employee-owned companies. By David Hetherington.

Progressive Economics

July 24, 2008

The Full-Cost Economics of Climate Change: An Aluminium Case Study

This report applies a full-cost economics approach to climate change adaptation, using the aluminium industry as a case study to illustrate the complexity of the policy challenge. The report examines the positive value of jobs within the upstream aluminium industry, and the negative value of carbon emissions from the sector. By David Hetherington.

Progressive Economics

November 24, 2007

Memo to a Progressive Prime Minister: Australia: The Investing Society

This is an updated version of a report first written after the 2007 election of Prime Minister Kevin Rudd. It

proposes a new progressive governing project. We call this project the Investing Society: a renewed investment in sustaining our prosperity and in strengthening our communities. By David Hetherington and Tim Soutphommasane.